Automate Accounting and End-to-End Transactions

Free accounting software providing a complete solution for bookkeeping, bank reconciliation, and automated tax compliance for businesses.

Free accounting software providing a complete solution for bookkeeping, bank reconciliation, and automated tax compliance for businesses.

Accounting requires financial management by automating complex bookkeeping tasks. It provides real-time visibility into cash flow through seamless bank synchronization, fiscal localisation, and automated reconciliation. By integrating natively with sales and inventory, it ensures data consistency across the organization, enabling precise financial reporting and simplified journal handling within a single, secure ecosystem.

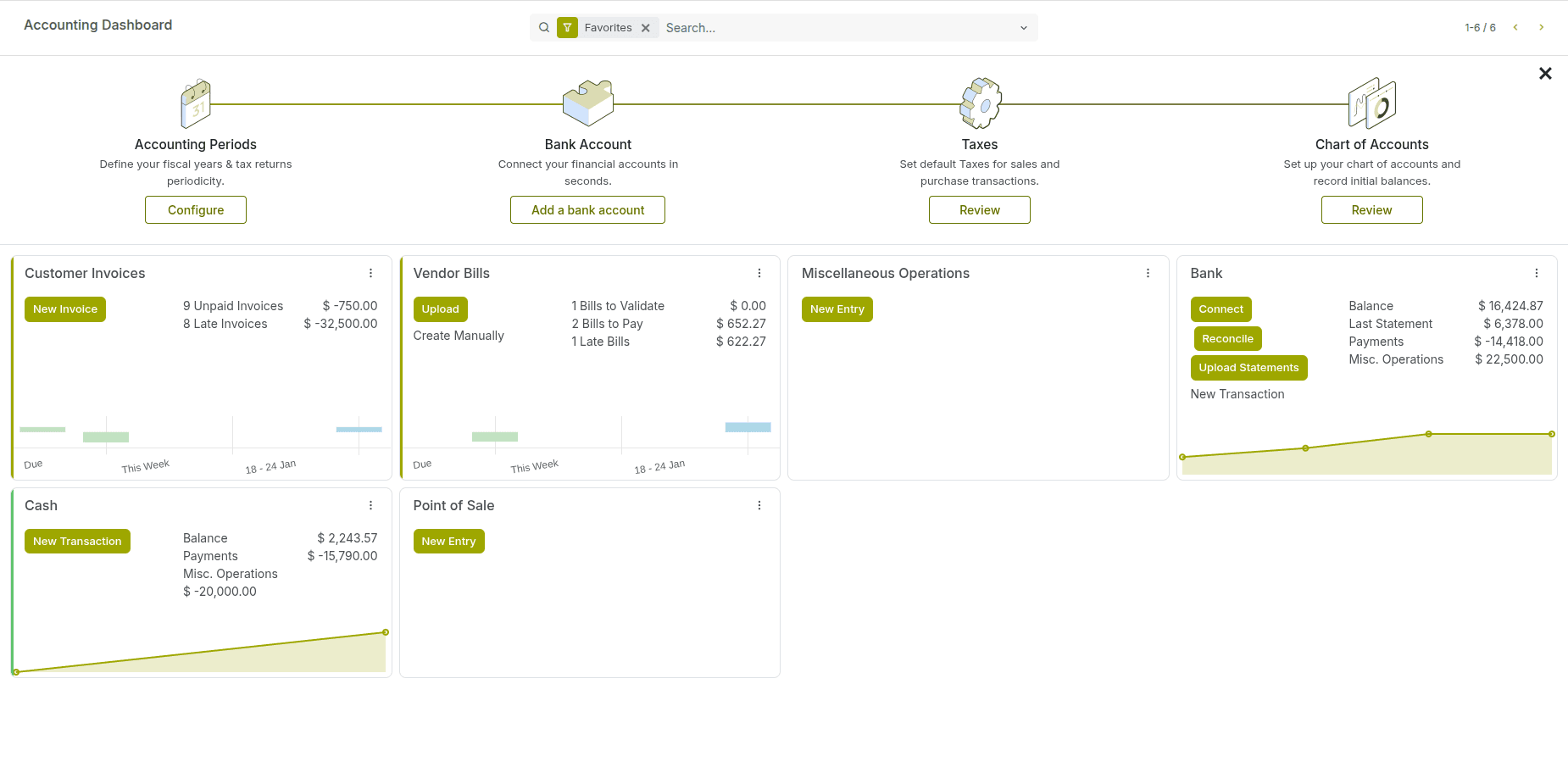

The accounting dashboard is your starting point — giving instant visibility into invoices, payments, bank balances, and cash flow the moment you open the module.

Track key accounting metrics, analyze trends, and make informed business decisions using clear, up-to-date financial data.

Quickly validate transactions, clear outstanding records, and keep your accounts accurate and up to date — all from an intuitive reconciliation interface.

Match payments, invoices, and bank transactions in just a few clicks. Cyllo automatically detects matches and suggests entries, making reconciliation faster and error-free

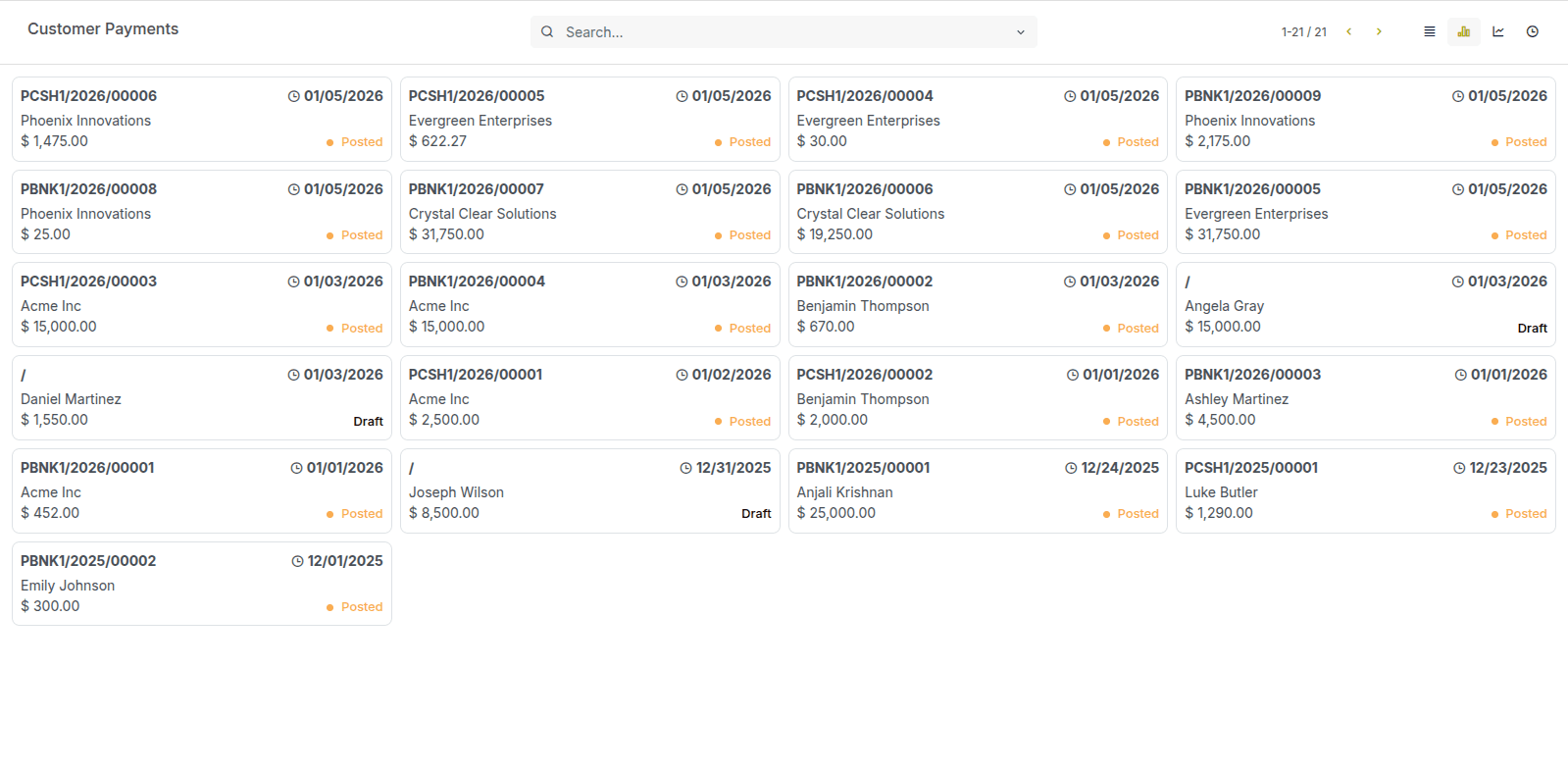

Access a consolidated list of all payment entries, helping you manage approvals, validations, and follow-ups with ease.

Handle refunds and credit notes with ease, right from the payment form. Review details, link adjustments, and keep every financial movement transparent and traceable.

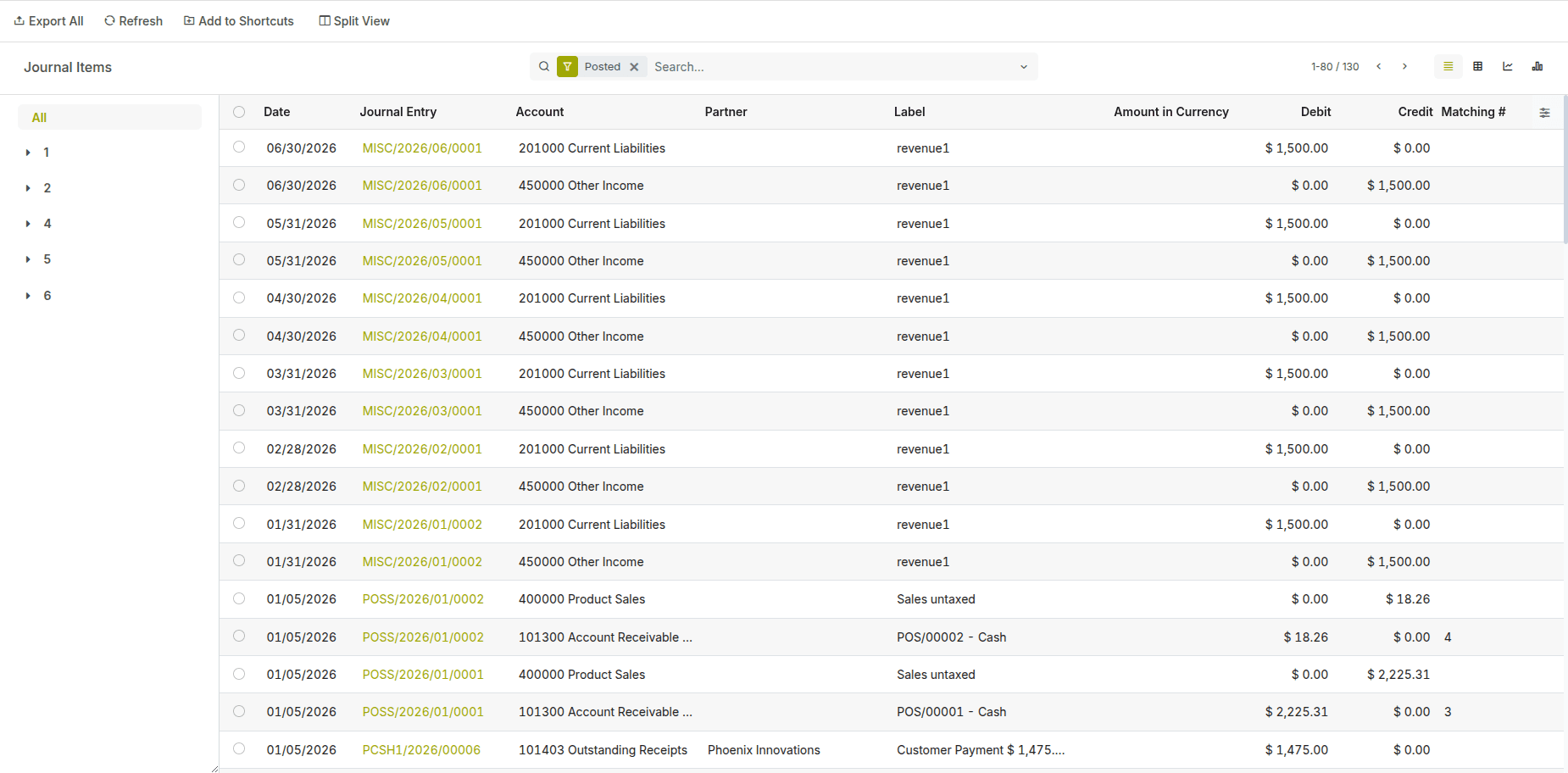

Dive into every debit and credit line to see how transactions flow through accounts — giving you a precise, granular view of your financial data.

Explore detailed journal item records that reveal the real accounting impact of each transaction, with full clarity across accounts and balances.

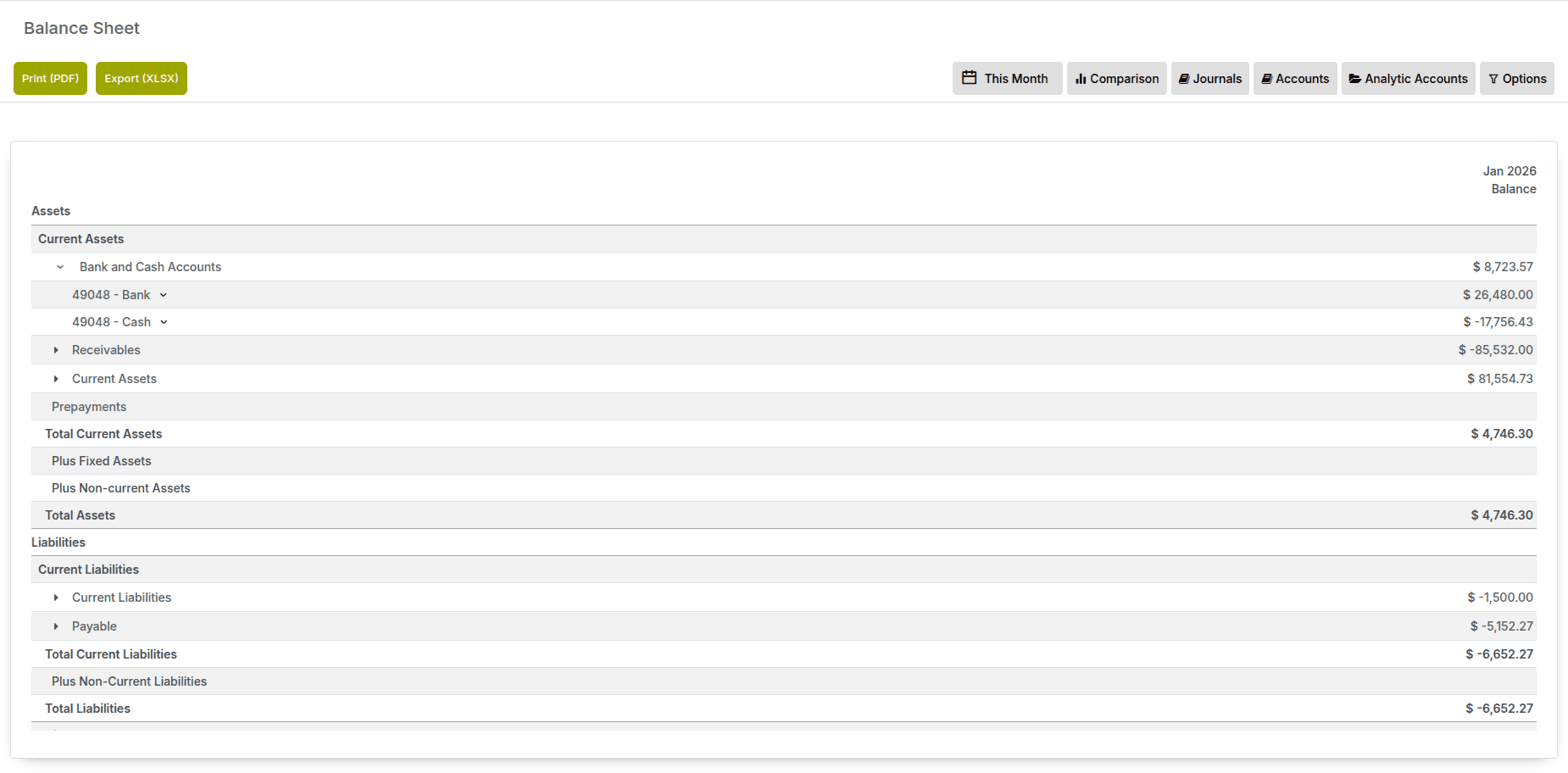

View your assets, liabilities, and equity in one powerful report — giving you a clear picture of financial position and long-term stability.

Dive into powerful balance sheets, P&L statements, and general ledger etc.. Bringing clarity to your finances and insight to every business decision.

Recognizes cost of goods sold at the time of invoicing rather than at stock delivery. This provides more accurate profit tracking by aligning expenses directly with sales revenue.

Allow income or costs to be recognized gradually over time instead of immediately. This ensures compliance with accounting principles by matching revenues and expenses to the correct periods.

Effortlessly link your bank accounts to Cyllo Accounting, ensuring that all your financial activities are tracked and reconciled accurately.

Allows companies to record transactions in different currencies while automatically converting values using up-to-date exchange rates. It ensures accurate accounting, reporting, and financial consolidation.

Automatically maps taxes and accounts based on customer or vendor location and tax rules. It ensures the correct tax treatment is applied without manual adjustments.

Helps plan, track, and control expenses by comparing actual spending against predefined budgets. It enables proactive financial control and informed decision-making.